How do I apply taxes for my services?

Before you begin using the checkout feature, it is crucial that you apply taxes to your services and products so that you can charge the appropriate amount for your customers. By default, no taxes are applied so if your business does not charge tax, then there is nothing for you to worry about. If you do require it, please follow these steps to set it up:

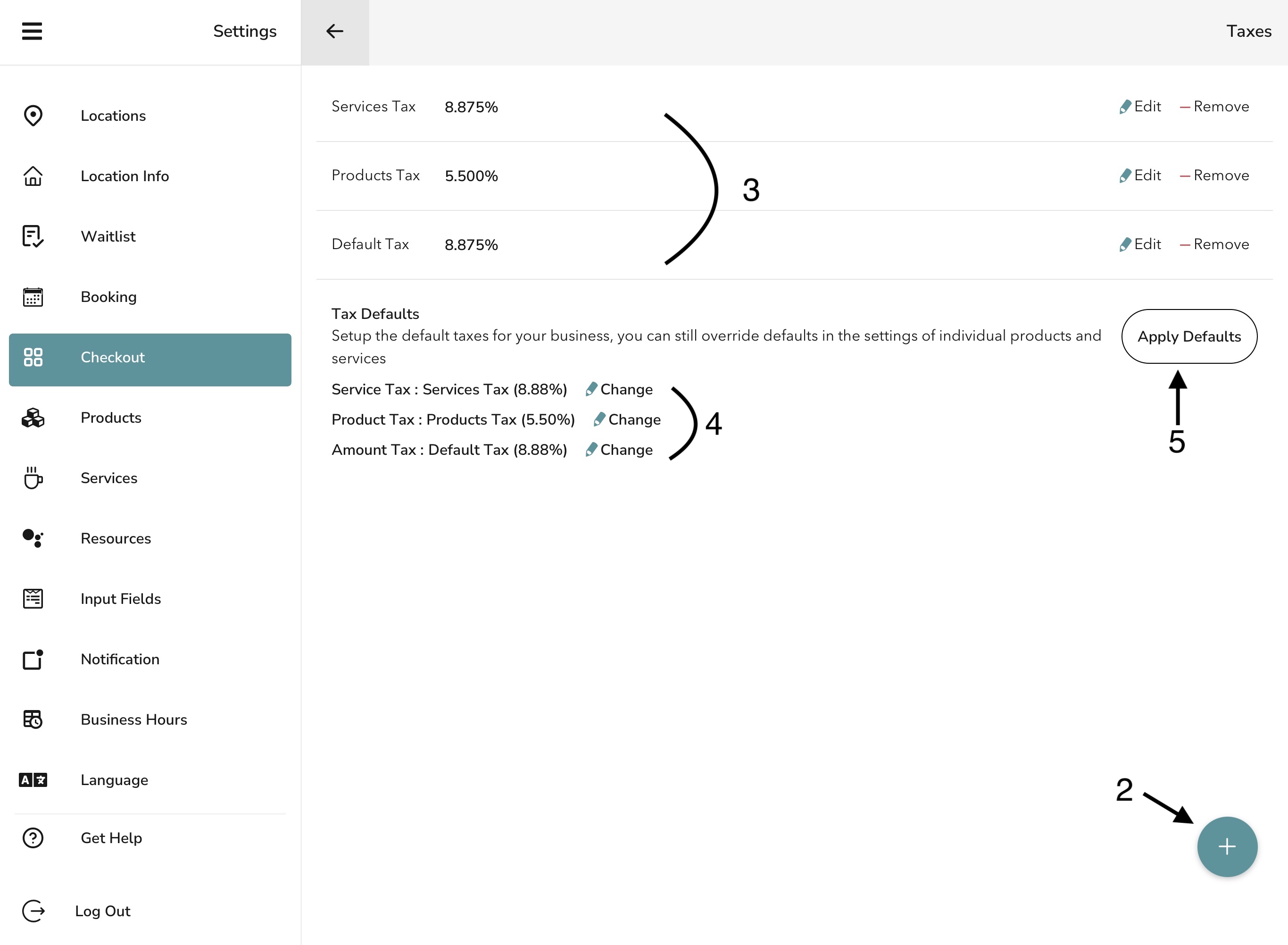

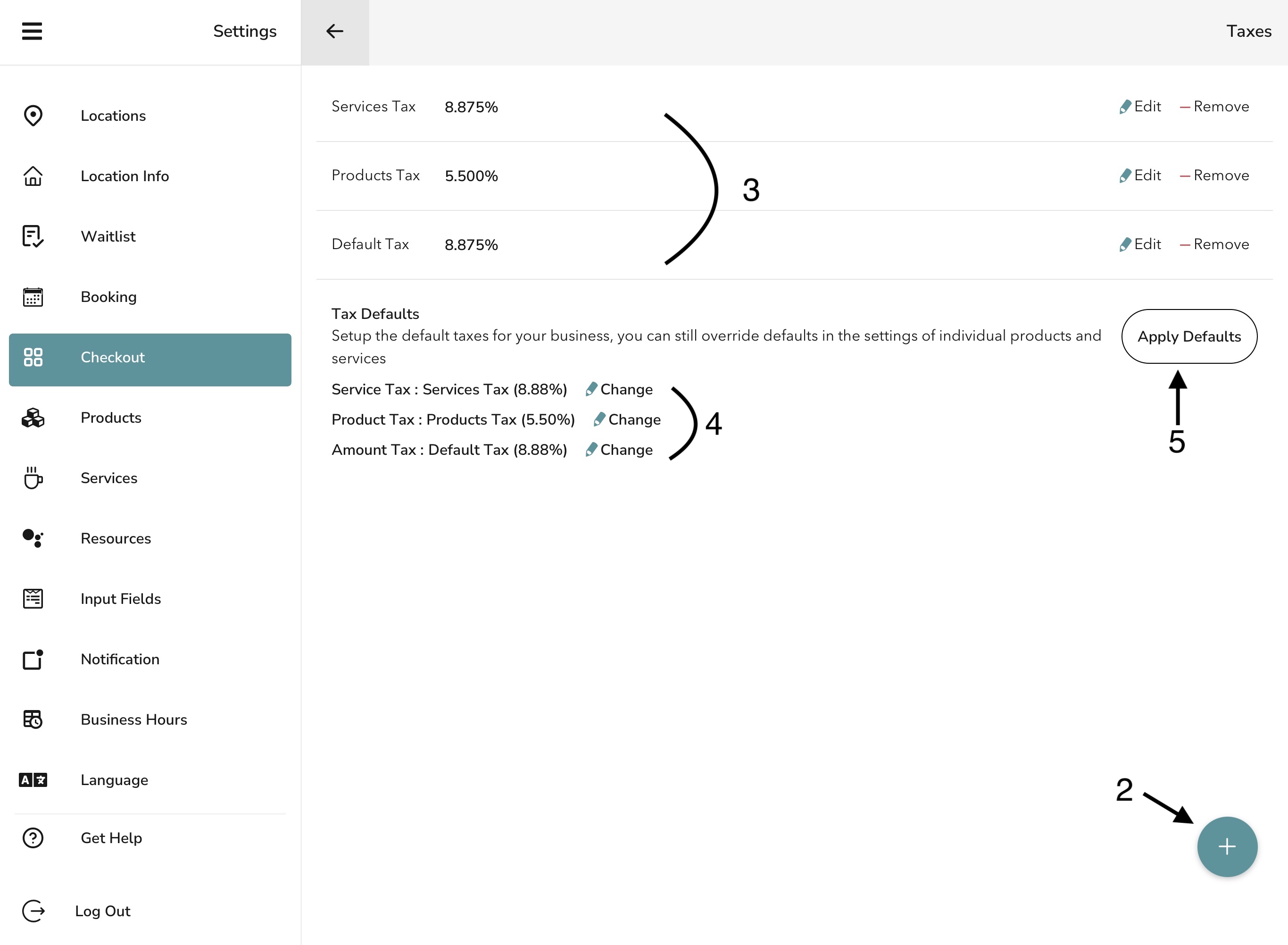

- Navigate to Settings > Checkout > Taxes.

- Click the "+" at the bottom right. You can create as many tax rates as you need.

- Your created tax rates will show up at the top for your convenience in case you need to edit the rate or remove it entirely.

- Under the tax defaults section, click Change and apply the tax rate you would like for each category.

- Service Tax: the tax rate for your services

- Product Tax: the tax rate for your products

- Amount Tax: the tax rate for custom amounts(using the keypad in checkout)

- Once you are satisfied, click Apply Defaults. This will apply the selected tax rate to all your currently existing services and products. For new services/products that you've created, you can simply click Apply Defaults again.

Note: if you certain services or products with different tax rates, you can set the tax rates individually for these items. In the create or edit interface, scroll to the bottom and you will see a Tax section where you can input a tax rate.